Published by Business Day, Friday April 19th 2013. Opinion and Analysis Section, p11

Taking leave of her long suffering shareholders, Cynthia Carroll chose to admonish rather than commiserate with them. As the Financial Times reported:

In a parting shot at shareholder demands for greater cash returns, Cynthia Carroll told the FT that there was a “disconnect” between mining companies and investors, adding that the latter need to understand better “what it really takes to deliver projects”.

“Some [shareholders are] under severe pressure and want a return tomorrow. They’re going to be hard-pressed to get them because it’s not going to happen that way. We have to be ruthless in terms of what [costs] we’ve got to cut but we have to be mindful we’re in a long-term industry.”[1]

The truth about the recent behaviour of investors in Anglo is that far from any alleged short term disconnect between price and performance, as alleged, Anglo shareholders are demonstrating remarkable patience in the face of a simply disastrous performance of the company in recent years that has seen Anglo’s earnings collapse. Blaming the global slowdown and super cycle bust ring hollow when judged by Anglo’s poor performance relative to that of its large diversified mining house peers. BHP Billiton, Rio Tinto and Anglo American are all listed on the FTSE in London. Since 2007 when Ms Carroll became CEO, BHP Billiton has beaten the FTSE by a factor of 1.95; Rio Tinto has beaten it by 1.31 and Anglo has returned only 0.61 relative to every £1 invested in the FTSE. This is a sad case of sterling underperformance.

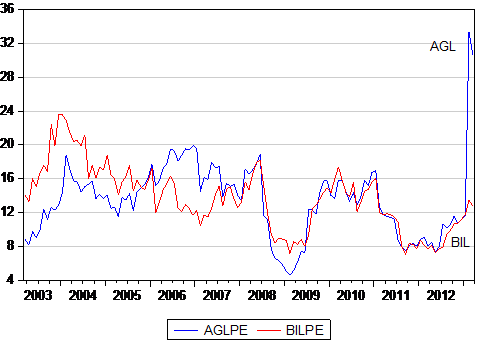

The price to earnings multiple for Anglo has shot up lately in response to a collapse in reported earnings after taxes and write offs. Thus indicating very clearly that shareholders are hopeful that earnings will recover in due course. Let us hope that their confidence in the newly appointed Anglo management to affect a recovery in the mining house operations will be justified. Far from being short cited in the face of very poor recent results investors are proving remarkably loyal to Anglo.

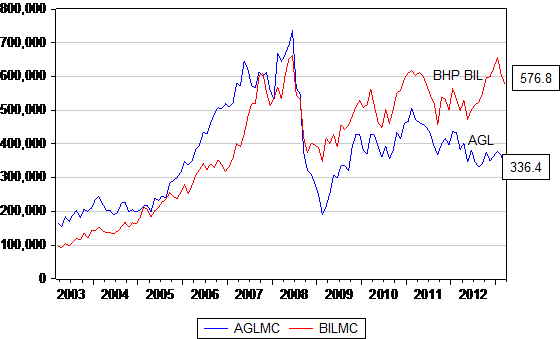

The sad news about Anglo’s (AGL) performance under Ms Carroll’s watch is easily captured in a few more diagrams. We show that while AGL was once worth more than BHP Billiton (BIL), its market value is now considerably lower. From a peak market value of over R700b in 2007 before the Global Financial Crisis struck, the company was worth less than half R336.4b by March 2013. As we show BIL held up much better over the period and is now worth significantly more than AGL (approximately R230b more at the March 2013 month end). Compared to early 2003 before the commodity super cycle shareholders would have done about three times better holding BIL than AGL shares.

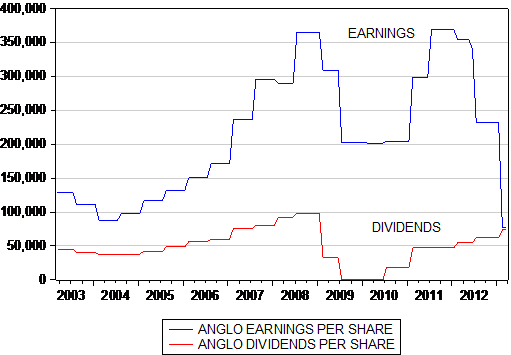

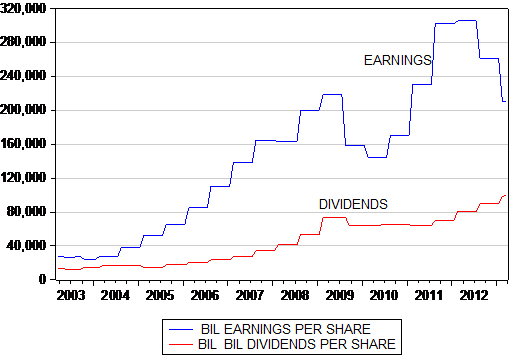

Such relative performance is well explained by earnings and dividends per share. Anglo’s after tax earnings per share having collapsed in the past financial year to December 2012 is now below its level of early 2003. BIL earnings per share, while also under strong downward pressure, grew much faster over the ten year period and are well above 2003 levels as we show. The upshot of all this history is that AGL was selling at the March 2013 month end for a highly generous and forgiving multiple of over 30 times its reported earnings while BHP Billiton commands a much more sober multiple of 12.8 times. The average price to reported earnings multiples for both companies over the past ten years has been about 13.5 times. Based on this measure, Anglo is priced for a recovery and normalisation of its earnings.

Anglo American and BHP Billiton Market Value (R’ 000m)

Ratio Market value of Anglo/ BHP Billiton 2003=1

Anglo American Earnings and Dividends per share (2003- 2013; South African cents )

BHP BILLITON Earnings and Dividends per share (2003- 3013 sa cents)

Anglo American and BHP Billiton Price/Earnings Multiple

While price earnings multiples give an impression of the long term expectations that inform market values, we can take a closer look at the South African mining industry to judge more accurately what the market expects of the mining houses in terms of operating profitability and value creation.

Contrary to Ms Carroll’s statements and those of many other pundits unsympathetic to market forces investors have long-term expectations about growth, return on capital and risk when they value the anticipated future cash flow from companies. They take a long term view because it is the value adding viewpoint to adopt. Smart investors and corporate executives back into and analyse market expectations to understand current valuations before they buy or sell shares. If expectations appear too optimistic then the investment shouldn’t be made. Two much pessimism about the long term provides a buying opportunity.

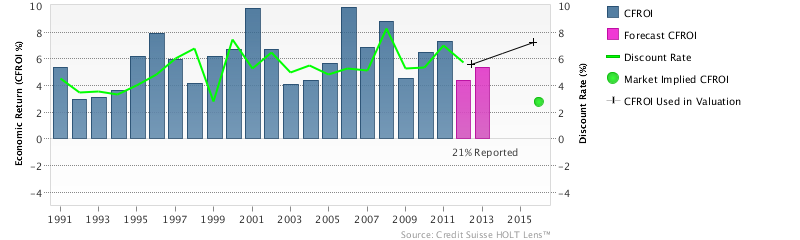

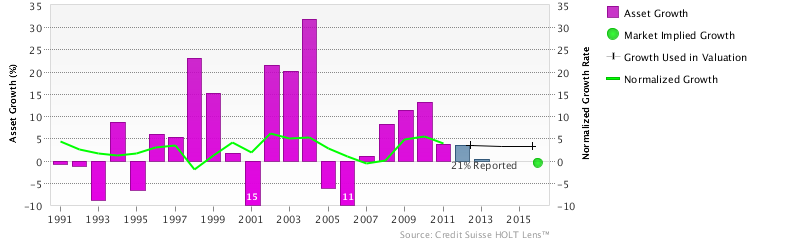

Using CFROI[2], which is a measure of the real cash flow return on operating assets, we investigate the return on capital implications implicit in the current values attached to the mining companies listed on the JSE.

The average real return on capital (CFROI) for global industrial and service companies is 6%. Firms that can generate operating returns that beat this level can generally be said to be creating shareholder value. Firms that generate real operating returns less than 6% are destroying shareholder value. South Africa (defined as firms listed on the JSE) has one of the highest median CFROI values in the world at 10%. This is something to be very proud of. In general, South African companies are very well managed and create shareholder value. If they can continue to generate returns that beat their cost of capital, they should re-invest their earnings and grow. It is not a lack of cash that stops companies from investing more in SA mining operations , but rather uncertainty about the risk and economics of future earnings from those investments. The government should do all it can to welcome investment and decrease uncertainty if it truly wishes to unleash growth.

Unfortunately, the South African mining sector has not generated a particularly attractive return on capital. The median CFROI for the aggregate South African mining industry is 6.2% over the past 20 years. It has exceeded 9% in only two years, 2001 and 2006. Many miners did very well during the commodities super cycle from 2006 to 2008 but have generated value destructive operating returns since. Platinum mining has provided a particularly disappointing return on capital since the super cycle collapsed as has much of the acquisition activity undertaken by the diversified miners.

SA Miners All Regions All Sectors – Weighted

And so what are the current expectations implied by current market values? The aggregate CFROI for the South African mining industry implicit in current valuations is expected to remain well below 6%, which is below the real cost of capital or the returns normally demanded of risky mining operations. Spiralling costs and low commodity prices are squeezing profitability, and this squeeze (undemanding expected returns) is baked into today’s lower share prices. If we compare forward expectations over the next five years for BIL, Rio Tinto and AGL, BIL is priced for its CFROI to go from 10% to 7%; Rio Tinto from 7% to 5%; and AGL from 5% to a value destructive 2%. Such low expectations indicate that AGL is either cheap or the market has decided it is a value trap. The onus is on management to prove the market wrong by improving operational control, not to blame the market for losing faith in the industry.

The share market doesn’t expect growth from the mining houses. It is rather demanding that the mining houses pay much closer attention to cost control and operational excellence. These low market expectations should act as a warning to managers, workers and the government responsible for mining policy. The lower profits and reduced growth expected is not in synch with demands for higher wages, electricity prices and government interference with mining rights and the taxation of mining profits. If these low expectations can be countered by sober management and relations, then these companies and their returns stand a stronger chance of recovering their status with investors. In the long run it will be the real return on the cash invested by the mining companies that will be decisive in determining their value to shareholders. In the long run economic fundamentals will trump what may be volatile expectations. The mining companies can manage for the long run with complete confidence in the willingness of the share market to give them time but must bear in mind that actions speak louder than words.

Brian Kantor and David Holland

[1] Read the full article at: http://www.ft.com/cms/s/0/6c73ab22-9489-11e2-b822-00144feabdc0.html

[2] Follow this link for more information about CFROI: https://www.credit-suisse.com/investment_banking/holt/en/education/popup_tutorial1.jsp