The term “helicopter money” has gained currency among economists and policymakers in recent times. We discuss the practical implications of this policy tool and contrast the challenges faced by developed markets with those of SA

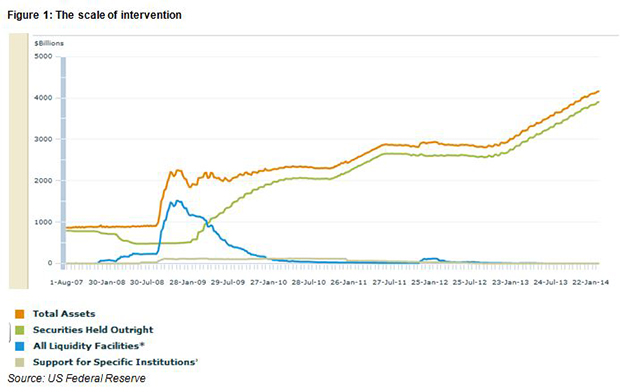

After several years of quantitative easing (QE) – the process whereby the central bank buys up assets like government bonds in order to inject cash into the monetary system – the developed world has found that, while outright disaster may have been averted, it has not delivered the robust growth that was hoped for.

Economists and policymakers are now considering other stimulatory tools, including fiscal measures and “helicopter money” to lift developed market economies out of the apparent quagmire of very low growth.

The notion (metaphor) of helicopter money (also known as “QE for the people”) was first invoked by the foremost monetarist Milton Friedman and revived by Ben Bernanke, later chairman of the US Federal Reserve (Fed), to indicate how central banks might overcome a theoretical possibility that has become a very real problem for central bankers today.

The metaphor was derived from a parable in Friedman’s famous 1969 paper “The Optimum Quantity of Money”:

Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us suppose further that everyone is convinced that this is a unique event which will never be repeated.

The idea was picked up in subsequent years by others, including Bernanke, who noted in 2002 (while still a Fed governor) while speaking about deflation in Japan, how John Maynard Keynes “once semi-seriously proposed, as an anti-deflationary measure, that the government fill bottles with currency and bury them in mine shafts to be dug up by the public”. Bernanke added that “a money-financed tax cut is essentially equivalent to Milton Friedman’s famous ‘helicopter drop’ of money.”

The concept has gained further currency in recent years in the light of extremely low inflation in many developed economies. In this article, we look at some of the implications and practicalities of such measures and then contrast this with the policy approach that has been used in SA. First however, some context on the policy of QE that has become the mainstay for central banks in the developed world over the last eight years or so.

A question of QE

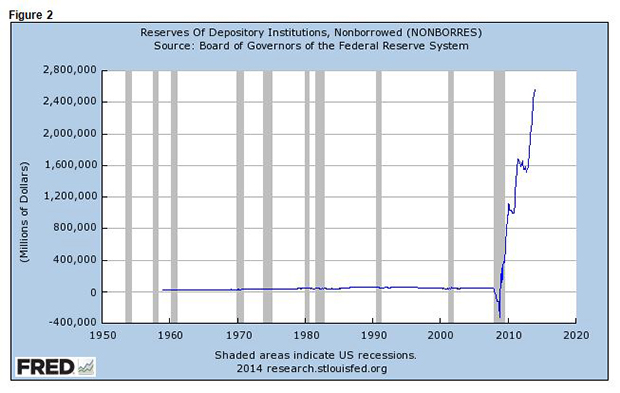

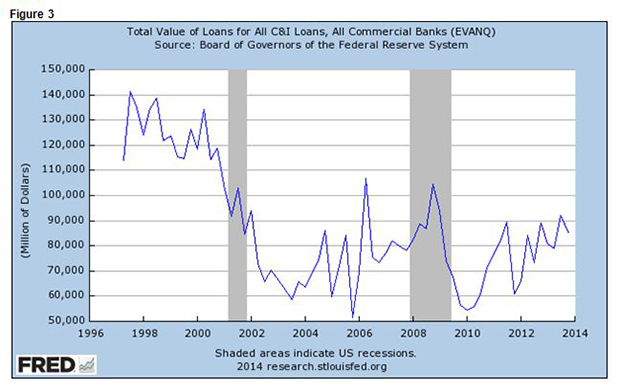

Central banks of the US, Europe and Japan, have created vast quantities of extra money in recent years through QE, quantities that would have been unimaginable before the Global Financial Crisis of 2008. Unfortunately, these have been bottled up in the banks who have held on to the extra cash received rather than used it to make loans that would have helped their economies along.

The cash was received by the banks or their customers from the central banks in exchange for government bonds and other securities bought from them in the credit markets and directly from the banks themselves. The cash shows up as extra deposits held by private deposit taking banks with their central banks – the bankers to the banks. This process of QE has led to the creation of trillions of dollars, euros or other currencies of extra assets held by central banks – matched by an equal growth in their liabilities, mostly to the banking system in the form of these extra deposits (see below).

Source: Federal Reserve Bank – Recent Balance Sheet Trends

Figure 2: Federal Reserve System of the US: Total assets and composition of assets

Source: Federal Reserve Bank – Recent Balance Sheet Trends

But why did these central banks create the extra cash in such extraordinary magnitude? In the US it was to rescue the banking and insurance systems from collapse in the face of their losses incurred in the debt markets following the failure of a leading bank, Lehman Brothers, that might have brought down the financial system with it. In Europe it was to prevent a meltdown in the market for most European government debt that could have brought down all lenders to government – not only banks but pension funds and insurance companies and their dependents. In Switzerland the cash came from purchases by the central bank of dollars and euros that flooded into the Swiss banking system and would otherwise have driven the Swiss franc even stronger than it has become. In Japan the extra cash was designed to offset the recessionary and deflationary forces long plaguing the economy.

The original purpose of QE in the US and Europe was to prevent a financial collapse. The second related reason was to fight recession and deflation. Extra money and the lower interest rates accompanying it are meant to encourage extra spending and lending. Extra money and lower interest rates usually do this to an economy – stimulate demand. Usually with extra demand comes higher prices and inflation.

The banks receive the extra cash directly from the central bank in exchange for the securities previously held on their own balance sheets or they may receive the extra central bank cash, with the deposits made by their clients when banking the proceeds of their own asset sales. Their clients deposit the cheques or, more likely, EFTs issued by the central bank in their private banking accounts and the banks then receive an equivalent credit on their own deposit accounts with the central bank as the cheques on the central bank are cleared or the EFTs are given electronic effect. And so in this way, through asset purchases by the central bank acting on its own initiative, extra central bank money enters the financial system, a permanent increase that can only be reversed when the central bank sells down the securities it has bought.

The banks have an option to hold the extra cash rather than lend it out to firms or households, who would ordinarily spend the cash so made available. And banks in the US, Japan, the Eurozone, UK and Switzerland have done just this in an extreme way. They are holding the extra cash supplied to them by their central banks as additional cash reserves, way in excess of the requirement to hold them.

The US money base shown below is the sum of currency and bank deposits (adjusted for reserve requirements) held with the central bank. Note how the US money base has grown in line with excess reserves held by the Fed and the extraordinary growth in the deposits held by Swiss banks with the Swiss National Bank.

Figure 4: Adjusted monetary base of the US

Figure 5: Excess reserves of US depository institutions

Figure 6: Swiss monetary base

Bringing in the helicopters

It’s here where the call comes in for metaphorical helicopters to bypass the banking system and jettison bundles of cash that people would pick up gratefully and spend on goods and services, so reviving a stagnant economy (stagnant for want of enough demand, not for want of potential output and employment that is the usual economic problem).

But will the helicopters come in the form imagined by Friedman, Bernanke and others? In reality they are likely to take a different form. They will have to be ordered by governments and budgeted for in Congresses or Parliaments. Central banks can buy assets in the financial markets and directly from banks. They cannot order up government spending that they can help fund. That is the job of governments, who decide how much to spend and how to fund it. Governments can fund spending by taxing their citizenry, which means they (the citizens) will have less to spend. This is never very popular with voters. They can also fund government spending by genuine borrowing in the market place – competing with other potential borrowers – crowding them out by offering market-related interest rates and other terms to lenders. Or they can fund their expenditure by calling on the central bank for loans that, as a government agency, they cannot easily refuse to do.

In taking up the securities offered to them by the government, the central bank credits the deposit accounts of the government and its agencies with the central bank to the same (nominal) value as the debt offered in exchange. Both the assets and deposit liabilities of the central bank then increase by the same sum, as the extra debt is bought by the central banks and the government deposit credited. As the government agencies write cheques on their deposit account – or do the EFTs on them – the government deposit runs down and the deposits of the private banks with the central bank run up. In this way, the supply of cash held by the private sector increases, just as it does in the case of QE.

And the private banks and their customers will have the same choice about what to do with the extra cash held on their own balance sheets. Spend more, lend more or pay back debts or hold the extra cash, as they have largely been doing.

But there is an important difference when the money is created to fund extra government spending. Spending by government on goods, services or labour (or perhaps welfare grants) will have increased, so directly adding to aggregate spending. By spending more, the revenues of business suppliers and the incomes of households will have risen with their extra money balances received for their services or benefits. This makes it more likely that they will spend at least some of their extra income, generating what is known in economics as a multiplier effect. This is why spending by government can be highly inflationary, as it was in the Weimar Republic of Germany after World War 1 or as it was in Zimbabwe not so long ago or as it is now driving prices higher in Venezuela.

But the current danger in the West is deflation, the result of too little, rather than too much spending. Inflation seems very far away, as revealed by the very low or even negative interest rates offered by a number of governments (in the form of negative yields on government debt) to willing lenders for extended periods of time. For some governments, issuing debt – at negative interest rates that produces an income for the government – is cheaper than issuing cash, that is the non-interest bearing debt of the government and usually the cheapest method for funding its expenditure. How can they resist the temptation to generate government income by issuing more debt for an extended period of time? Not easily, we would suggest.

The continued weakness of developed economies suffering from a lack of demand, despite low interest rates, calls for money and debt – or money creation by governments. The call for less austerity or more government spending relative to taxes collected, is being heard in Japan. It is a voice being sounded loud and clear in post-Brexit Britain. The Italians are very anxious to use government money to revive their own failed banking system. The Germans, with their own particular Weimar inflation demons, will however resist the idea of central banks directly funding governments, but for how long? Hillary Clinton promises spending on infrastructure. Donald Trump worries little about debt of all kinds – including his own (for now, as far as we can tell).

How long can weak economies co-exist with very low interest rates and abundant supplies of cash? It will not take helicopters but unhappy voters to stimulate more government spending, funded with cheap debt or cash. And the voters appear particularly restless on both sides of the Atlantic and, for that matter, the Mediterranean. The next few years promise to be intriguing ones for the governments and electorates of these countries.

Meanwhile in SA – a different world

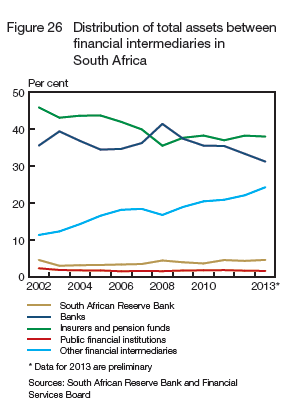

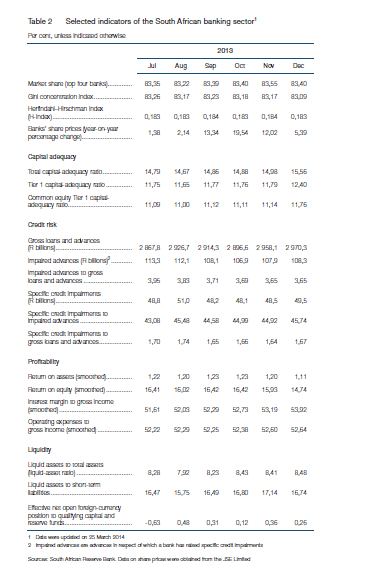

At this point it is worthwhile to compare and contrast policy actions in the developed world with those in SA. The Reserve Bank (the Bank) has not practised QE. By contrast, SA banks, rather than being inundated with cash and excess reserves, have been kept consistently short of cash in support of the interest rate settings of the Bank. SA banks borrow cash from the Bank rather than hold excess cash reserves with it.

SA banks do not therefore hold reserves in the form of deposits at the central bank in excess of the reserves they are required to hold. As may be seen in the figures below, by contrast with their developed world counterparts, the SA banks are kept short of cash through liquidity absorbing operations by the Bank and, more importantly, by the SA National Treasury.

Also to be noted is the liquidity provided consistently to the banking system by the Bank in the form of repurchases of assets from them as well as loans against reserve deposits. Rather than holding excess reserves over required cash reserves, the SA banks consistently borrow cash from the Bank to satisfy their regulated liquidity requirements.

It is these loans to the banking system that give the Bank its full authority over short-term interest rates. The repo rate, at which it makes cash available to the banks, is the lowest rate in the money market from which all other short-term interest rates take their cue. Keeping the banks short of cash ensures that changes in the policy-determined repo rate is made effective in the money market – that is, all other rates will automatically follow the repo rate because the banks are kept short of cash and borrow reserves rather than hold excess cash reserves.

In the US, the Fed pays interest on the deposit reserves banks hold with the Fed. The European Central Bank (ECB), for its part, applies a negative rate to the reserves banks hold with it. In other words, Eurozone banks have to pay rather than receive interest on the balances they keep with the ECB as an inducement to them to lend rather than hoard the cash they receive via QE.

The cash reserves the SA banks acquire originate mostly through the balance of payments flows. Notice in the figure below that the assets of the Bank are almost entirely foreign assets. Direct holdings of government securities are minimal, as reflected on the Bank balance sheet. When the balance of payments (BOP) flows are positive, the Bank can add to its foreign assets and when they are negative, run them down. The Bank buys foreign exchange in the currency market from the private banks (and credits their deposit accounts with the Bank accordingly) or sells foreign exchange to them and then calls on their deposit accounts with the Bank for payment.

Thus, when the BOP flows are favourable, the Bank may be adding to its foreign assets and so to the foreign exchange reserves of SA via generally anonymous operations in the foreign exchange market. In so doing, it is acting as a residual buyer or seller of foreign exchange and, as such, will be preventing exchange rate changes from balancing the supply and demand. With a fully flexible exchange rate, no changes in foreign exchange reserves would be observed, only equilibrating movements in exchange rates. The exchange rate will strengthen or weaken to equalise supply and demand for US dollars or other currencies on any one trading day without causing any change in the supply of cash, that is in the sum of bank deposits held with the Bank.

The foreign assets on the Bank balance sheet have however increased consistently over the years as we show in the figure below. Hence influence of the BOP on the money base (on the cash reserves of the banks) has been a strongly positive one.

Without intervention in the money market, these purchases of foreign exchange by the Bank would automatically lead to an equal increase in the cash reserves of the banking system. Their deposits at the Bank would automatically reflect larger deposit balances as foreign exchange is acquired from them and their clients. This source of cash however has been offset by SA National Treasury operations in the money and securities markets.

To sterilise the potential increase in the money base of the system (defined as notes plus bank deposits at the central banks less required reserves) the Treasury issues more debt to the capital market. The debt is sold to the banks and their customers – they draw on their deposits to pay for the extra issues of debt – and the Treasury keeps the extra proceeds on its own government deposit account with the Bank. Provided these extra government deposits are held and not spent by the Treasury – as is the policy intention – the BOP effects on the money base (on bank deposits or reserves) will have been neutralised by increases in government deposits. (The money base only includes bank deposits with the Reserve Bank. Government deposits are not part of the money base.)

It is to be noted in the figure representing Reserve Bank Liabilities, how the Government Deposits with the Reserve Bank have grown as the Foreign Assets of the Bank have increased – extra liabilities for the Reserve Bank offsetting extra foreign assets held by the Bank. It is of interest to note that about half of the Treasury deposits at the Reserve Bank are denominated in foreign currencies.

Figure 7: SA Reserve Bank balance sheet: Assets

Source: SA Reserve Bank and Investec Wealth & Investment

Figure 8: SA Reserve Bank: Selected liabilities

Source: SA Reserve Bank and Investec Wealth & Investment

The net effect of recent activity in the money market has meant much slower growth in the supply of cash and deposits with the banking system. Despite the accumulation of foreign exchange reserves and because of the sterilisation operations undertaken by the Treasury, the money base in SA has grown relatively slowly, as have the broader measures of the money supply, M2 or M3, that incorporate almost all of the deposit liabilities of the banks to their creditors. This has been matched by equally slow growth in the supply of and demand for bank credit that makes up much of the asset side of bank balance sheets. This slow growth has been entirely consistent with weak growth in aggregate spending and GDP. Compare and contrast this with how rapidly money and credit grew in the boom years of 2004-2008 (see below).

Figure 9: Growth in SA money base (adjusted for reserve requirements) and broadly defined money supply (M3)

Source: SA Reserve Bank and Investec Wealth & Investment

Figure 10: Growth in S money supply (M3) and bank credit and direction of the business cycle

Source: SA Reserve Bank and Investec Wealth & Investment

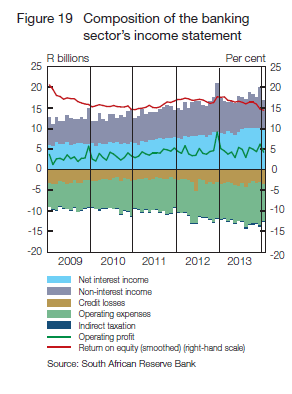

The shortcomings of SA monetary policy

One test of monetary policy is its ability to moderate the amplitude of the business cycle. The strength of the boom between 2004 and 2008 and the subsequent collapse – and the persistently slow growth in money credit and spending after 2011 – indicates that monetary policy in SA has not been notably counter-cyclical. Nor can it claim much success in limiting inflation even as growth in aggregate spending (Gross Domestic Expenditure – GDE) and output (Gross Domestic Product – GDP) has remained very depressed.

Economic activity picked up when inflation subsided between 2003 and 2005, because the exchange value of the rand recovered strongly and because interest rates declined with less inflation. The SA economy enjoyed boom time conditions between 2004 and 2007. The interest rate cycle turned higher in 2006, well before the Global Financial Crisis broke in September 2008 and yet was accompanied by rand weakness. Inflation accelerated in 2006-7 as the exchange rate weakened and inflation rates remained high as exchange rate weakness persisted until early 2009. Lower interest rates followed a rand recovery in 2009 and lower inflation rates that continued until mid-2010. Interest rates were stable to marginally lower until the end of 2013, but reversed course in early 2014 after inflation picked up and came to threaten the upper band of the inflation targets set for the Reserve Bank. This higher inflation followed the high degree of rand weakness after 2011 that was linked (mostly) to global risk aversion and lesser flows to emerging market bonds and equities. This rand weakness persisted until May 2016 as the economy slowed down markedly under the influence of higher prices and higher interest rates. These higher interest rates further weakened demand that was already under pressure from higher prices, without appearing to do anything to slow down inflation. Inflation continued to tack its cue from a persistently weaker rand, while a drought and higher prices for staple foods added materially to measured inflation in 2015-2016.

These dilemmas for a monetary policy that attempts to meet inflation targets, without regard to the causes of inflation – the result of fewer goods and services supplied rather than more demanded – has meant having to sacrifice growth without reducing inflation. Such unfortunate trade-offs for monetary policy – achieving slower growth yet accompanied by more inflation – will persist if exchange rate changes remain largely driven by global forces or other supply side shocks. These include drought or higher expenditure taxes, to which the Bank has responded with higher interest rates regardless of the causes of inflation. For the history of inflation, interest and exchange rates since 2000, see the figure below that identifies the phases of higher and lower interest rates.

Figure 11: Interest rates, inflation rates and the trade weighted rand (2000-2016)

Source: SA Reserve Bank and Investec Wealth & Investment

The recovery in the rand over the last few months offers the hope of a cyclical recovery, similar to events after 2003 – though should it materialise it is unlikely to be of the same strong amplitude. The stronger rand brings less inflation in its wake, as would any normal harvest. Less inflation means less inflation expected and a much improved chance of interest rates falling rather than rising, as they have been doing since January 2014.