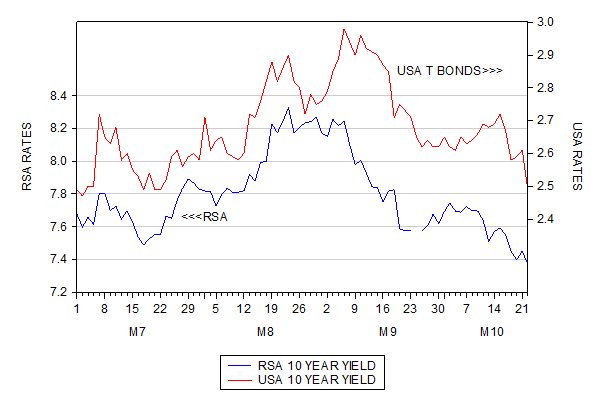

With the US government back to its spending and borrowing ways until at least January 2014, long dated US Treasury yields fell yesterday to their lowest levels in four months three months. RSA yields followed suit also reaching their lowest levels since July. (See below)

RSA and USA 10 year bond yields (daily data)

Source; I-net Bridge and Investec Wealth and Investment

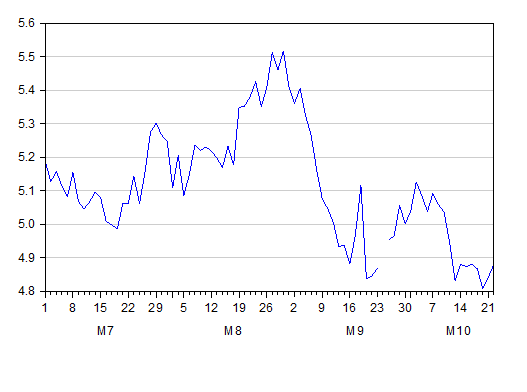

The difference between these yields may be regarded as the RSA risk premium or equivalently the average rate at which the ZAR/USD exchange rate is expected to depreciate over the next ten years. As may be seen this risk premium too has narrowed significantly since reaching its recent peak of over 5.5% p.a. in late August 2013. This was when US and RSA rates were at their recent highs on fears of QE tapering that have since been allayed. ( See below)

The RSA risk premium (daily data)

Source; I-net Bridge and Investec Wealth and Investment

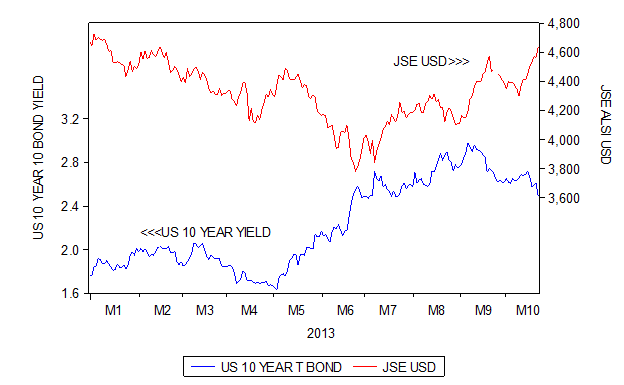

We have pointed to the key role played in global financial markets by US treasury yields. Emerging market equity, bond and currencies (of which SA is such a conspicuous component) are particularly exposed to higher US rates. As we suggested while rising yields might be good news about the improving state of the US economy rising yields in SA and other emerging market economies would not be at all helpful given that growth rates have been slowing down rather than picking up. For emerging markets, at least for now, the lower the US rates the better.

And so it has been proved. The decline in US rates has been very good news for the rand, the rand bond markets and also the JSE in rand and USD. In USD the JSE All Share Index has recovered strongly from its mid year lows and is now worth almost as much in USD as it was in January 2013. (See below)

US 10 year bond yields and the JSE (USD value)

Source; I-net Bridge and Investec Wealth and Investment

Again conventional wisdom about the rand has been proved wrong. It is a strong rather than a week rand that is good for the JSE. The factors that move the rand weaker or stronger- both for global and domestic reasons that encourage or discourage risk taking- are either harmful or helpful to the rand and simultaneously harmful or helpful to the USD as well as the rand value of SA listed assets.

Lower interest rates in the US have been good news for the rand and rand denominated stocks and bonds. The value of almost all financial assets measured in rands and dollars have moved move in the opposite direction to the rand cost of a dollar. Or if preferred, have moved in the same direction as the US dollar cost of a rand. Companies with predominantly dollar based revenues- are not in fact rand hedges- they do not gain value when the rand weakens – they simply lose less of their rand value than do the SA economy plays- when the rand weakens. They may also gain less rand and USD value when the rand strengthens. It would be better to regard companies listed on the JSE, whose operations are largely independent of the SA economy, as SA economy hedges rather than rand hedges.

2 thoughts on “Good news for SA – US bond yields are at three month lows”