The updates to the money supply and bank credit statistics (to July 2011) and GDP numbers (second quarter 2011) indicate that while the economy grew in recent months, it was at a declining rate. As is the inconvenient practice in SA, the GDP output and income numbers arrive unaccompanied by the other side of the national income identity, the aggregate expenditure estimates. And given that the current state of the SA economy can be attributed to little demand rather than to limits on the supply side of the economy, it is particularly inconvenient not to have details and explanations about the state of aggregate demand in the economy.

The GDP statistics indicated that activity closely connected to demands from households grew satisfactorily in the second quarter. Government consumption spending accounting for 15.9% of the economy (on employment benefits and consumables such as stationery and travel expenses etc) grew by a robust 5.7% (seasonally adjusted and annualized, as are all rates in this discussion, unless otherwise stated) in the quarter, while activity in the wholesale, retail and transport sectors (13.7% of GDP) grew by 4.1%. Activity in the very important financial and associated business service sectors (21% of GDP), grew by a more pedestrian 2.9%.

The laggards were primary production: agriculture (3.3% of GDP) and mining (7.2% of GDP) that declined at a 7.8% rate in the quarter with mining output falling at a 4.2% rate in the quarter. Industrial output declined at a seasonally adjusted 5.2% annual rate while manufacturing output, with only a 12.7% share of GDP, declined at a disturbing 7% rate. It should be appreciated that mining volumes and mining revenues can tell a very different tale, as they did in this quarter, when mining sales and profits were buoyed by rising prices, while the volume of output that could be exported was seriously constrained by railway capacity. As an indication of an improved top line for SA business the gross operating (profit) surpluses of business grew from R315bn in the first quarter to R346bn in the second. This surplus in money of the day was 11% greater than a year before. Employees took home an extra R7bn in the second quarter, representing an increase of 10%.

Thus the share of operating surpluses in gross value added continued to rise, to 48% while employees share was 44%, with the balance of value added attributed to taxes on output. South African business continues to become more profitable hiring fewer, better paid employees, whose share in value added has declined (despite higher real remuneration). Productivity therefore must have increased, aided by less expensive capital (which was freely available with a lower risk premium).

Money and credit: The housing factor

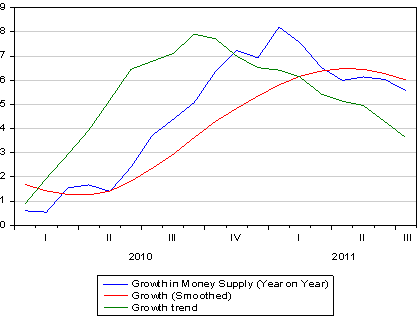

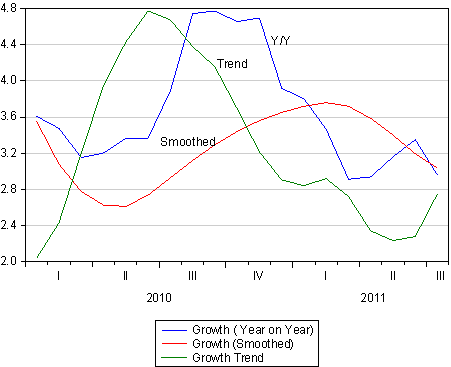

The underlying weakness in aggregate domestic demand is confirmed by the direction of money and credit supplies. As we show below the growth in the money supply broadly defined (M3) has picked up from mid recession growth rates of a year before. But the annual growth rates may well have stalled about the 5%-6% year on year rate. The private credit extended by the banks (approximately the other asset side of the balance sheets of banks) indicates a similar picture of growth, stabilizing at the 5% to 6% rate. The weakest aspect of bank lending, as may be seen, is mortgage lending. Growth in mortgage lending (while positive) appears to be declining to a roughly 3% year on year rate. This does not speak well of the housing market and the demand for extra building and renovation activity. Without a recovery in the housing market the top lines of the banks, about 50% dependent on mortgage lending, is unlikely to improve.

On the evidence of a slowing economy and growth in money supply and credit (which is barely keeping up with inflation), the case for lower interest rates to stimulate demand would seem uncontestable. The money market has begun to factor in the possibility of a cut in short term interest rates by the first quarter of next year. The odds of a 50bps cut in the repo rate are still below evens (about a 35% probability).

Unless the outlook for the domestic and global economies improves and money supply and credit growth pick up soon, these probabilities of a cut in rates will rise. Hindsight confirms what we have long argued, that interest rate settings in SA have been too high for too long for the sake of the economy – without any obvious influence on the exchange rate or the inflation outlook.