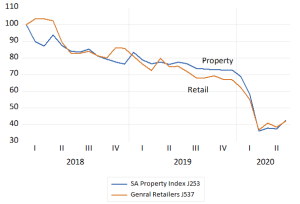

The threat to the value of SA retailers as cash has drained away during the lock downs has been as damaging to their landlords. The value of the average market weighted general retailer and property company on the JSE is less than 40 % of what they were worth in January 2018. The damage to the balance sheets of the property company of Covid19 is perhaps far greater than that of the average retailer. Who have shown a greater willingness to raise fresh equity capital to repair their balance sheets

The Value of JSE listed Property Companies and General Retailers January 2018 =100 Month end data to June 2020.

Source; Iress and Investec Wealth and Investment

A number of these JSE listed Real Estate Investment Trusts (Reits) with seemingly little growth in expected to come from SA assets, sought faster growth offshore. These offshore investments were funded very largely sometimes exclusively with foreign currency denominated debt.

The market value of average JSE Reit assets less debts, their net asset value (NAV) had fallen away before the Covid crisis that then decimated their rental revenues at home and abroad. A number of these JSE listed Reits now lack a sufficient buffer of equity to absorb the losses from COVID 19 related shutdowns. Debt to market value ratios have risen and NAV fallen further.

To qualify as Reits and avoid corporate taxes they are required to pay out at least 75% of their income after interest and all other expenses. They are appealing for an exemption from the Treasury and the JSE to skip dividends to conserve cash and still retain their Reit status.

They might do much better to raise equity capital, if they can, issue more shares for cash and pay off foreign and domestic debts. Even if the saving on foreign interest paid is minimal, provided the rand holds up, the improvements to their survival prospects and so market value could be substantial. Shareholders supported by stronger balance sheets could be well served facing up to a reduction in cash distributions per share. They would receive less income per share, but with lower risks attached to expectations of future distributions, this could add value to all the shares issued – even when there are more of them.

The purpose in raising capital may be, ideally, to grow a business successfully. Successful businesses mostly fund their growth from the cash they generate from operations. More unusually they may have to raise additional debt or equity capital secure the survival of a still potentially successful business.

The same fundamental question needs to be asked in both circumstances. Will in other words the increase in the market value of the company, plus the dividends paid, both measured in extra rands come to exceed the amount of extra capital raised. also in rands. Plus something extra to cover the opportunity cost of the capita raised. That is will the investment of extra capital return as much as could be expected from any alternative, as risky, a SA investment? Equal that is to the return from the bond market plus an equity risk premium- of about 5% p.a. (About 13% p.a.) If so investors will get all their capital back – and more – and perhaps very quickly as share prices could respond immediately to the expectation of good returns to come.

Any potential capital raise needed to save or de-risk a business will be reflected in the ongoing survival value of a company. Any surprising refusal of its owners to refuse to supply extra capital, when needed to secure the business as a going concern, will provide a very negative signal and surely damage the share price. Preventing the downside will be part of the upside of any capital raise.

A successful secondary issue, especially when underwritten by bankers exercising due diligence, is perhaps an even stronger signal of favourable longer- term prospects for any company. More so than a rights issue supported by established shareholders with everything to lose. With a successful secondary issue raising capital for the right value adding reasons, established shareholders can expect to have a smaller share of a larger cake and be better off for it.

The obvious way to maintain the share of established shareholders in a company is to raise extra debt, rather than equity capital. But more debt, makes any company more risky, and may destroy rather than add market value for shareholders. Debt only looks cheaper than equity with hindsight, after the good times have rolled by. And the good times may not last- as we have been so cruelly reminded.

One thought on “Fear debt – not raising equity capital – when it makes economic sense.”