Last week was not a good week for the JSE or the rand. The SA component of the MSCI emerging market index lost over 5% of its US dollar value at the beginning of last week compared to a loss of just over 2% recorded for the benchmark EM Index itself. The rand lost 2.4% of its US dollar value by the weekend and about the same against the weighted average currencies of its trading partners. Rand weakness versus the Aussie dollar, another commodity currency, was of the same order of magnitude.

Thus rand weakness was mostly behind the relative underperformance of the JSE. The issue then is what was behind rand weakness itself. Not surprisingly in these circumstances foreigners were net sellers of SA equities through the week and modest net buyers of SA rand denominated bonds.

Or, to put it the other way round, locals were net buyers of JSE listed stocks – though not enthusiastically enough to prevent a modest 1.76% decline in the rand value of the JSE. For every foreign net seller there has to be an equal and opposite net SA buyer and vice versa. When share prices generally fall it may be inferred that the sellers were more determined to sell than the buyers were keen to take stock off their hands.

Over the past 12 months it is foreign investors who have been the keen buyers and locals the less keen sellers, enough for the JSE and MSCI SA to have proved outperformers in a generally improved market.

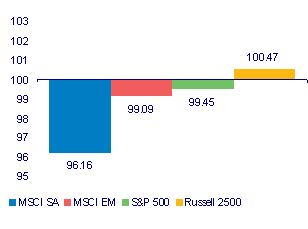

This year the S&P has proven to be a modest outperformer, with the JSE in US dollars and rands lagging behind and barely maintaining its values of 1 January 2011. We continue to argue that the most obviously least demandingly valued market is the S&P 500 with the JSE marginally less attractive than the MSCI EM. However we do not expect the performance of these three equity indexes to diverge greatly, dependent as they all are on global growth.

The strength of the global economy is reflected in commodity and metal prices. These as we show below have mostly moved sideways rather than higher over the past four months. However the great exception has been the price of oil as we show below.

Oil price shocks of this kind are more the result of the threat to supplies of oil from the Middle East than the impact of additional demands for oil emanating from an expanding global economy. As such they represent a threat to global growth and to other commodity and metal prices. Higher fuel prices absorb spending power and threaten higher inflation and higher interest rates. And so they also represent a danger to equity markets and to commodity currencies that do not have much oil or energy in their export baskets. In this regard the Aussie dollar may be somewhat better insulated than the rand.

Ideally from the perspective of investors in equities and resources (other than in oil and oil producers) the oil price will decline as fears about disrupted supplies decline. This will improve the outlook for growth, inflation and interest rates. A mixture of lower oil prices and stable, not necessarily higher, other commodity prices would be the right stuff for equity markets and the rand. Still higher oil prices would not be at all welcome.

To view the graphs and tables referred to in the article, see Daily Ideas in todays Daily View: Equity and currency markets: Oil price calls the tune?